Report Summary

Q3 2021

2 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Retailer Outlook

1. Supply chains

With Black Friday and the peak trading season fast approaching, supply chain disruptions are causing a real ‘headache’ for retailers as they scramble to meet demand.

Supply constraints on the back of labour shortages, manufacturing backlogs and shipping delays come at a time when businesses are grappling heightened demand.

Stock levels in relation to expected sales are at record lows across the retail sector (-21%), according to CBI.

Meanwhile, shipping costs have surged over the course of this year, up 249.3% YoY, with the Baltic Dry Index reaching the highest levels in over a decade.

2. Golden Quarter

The shape of Christmas changed dramatically last year as shopping was pulled forward, with October recording the strongest retail sales growth for six years.

Consumer fears around delivery delays and product availability, which caused this sales pattern, is likely to have a similar impact this year, given the well-documented supply chain issues (e.g. lorry driver shortage, fuel crisis)

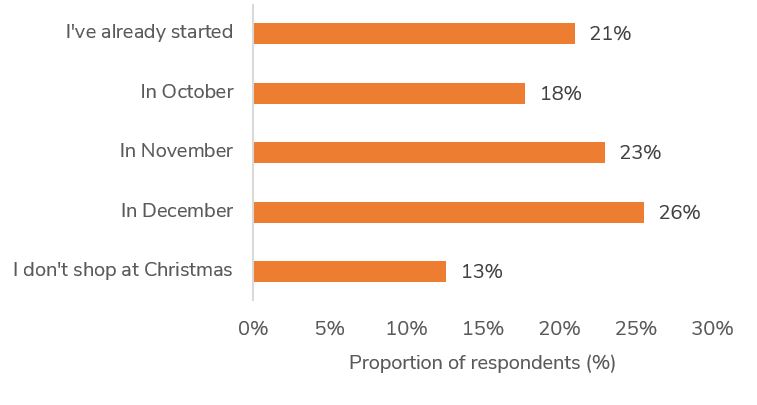

Retail Economics research shows that 39% of shoppers have already started their Christmas shopping or plan to in October.

Footfall is slowly recovering, narrowing the gap with pre-Covid levels. Shopper numbers were down 17.4% in September versus 2019, but up on the -18.6% recorded in August.

Retail Economics forecasts a slight drop in overall UK retail sales in Q4 2021 (-2.3% YoY) versus the same period in 2020. This is largely due to an anticipated fall in food sales, with grocery retailers expected to find it hard to compete with 2020 levels, when food sales surged amid hospitality closures.

3. Retail property

Retail property has been hit hard by Covid with multiple lockdowns accelerating structural changes within the industry. The UK now has an estimated 150 million sq. ft of vacant retail space, equivalent to 14.5% of retail units.

Shopping centres remain under the most pressure, with vacancy rates jumping from 17.1% at the end of 2020 to 19.4% in H1 2021 – the largest ever half-year increase.

The ban on commercial property evictions will remain in place until March 2022, after the government opted to extend it. However, this means that the issue of unpaid rent hangs over the sector, with retail and hospitality operators accruing more than £5.0 billion in rental arrears since March 2020.

Collaboration is key to rebuilding trust between landlords and tenants, enabling successful and sustainable lease negotiations

Consumer Outlook

1. Inflation

2. Confidence and propensity to spend

3. Housing market

Take out a free 30 day membership trial to read the full report >

When will you start your Christmas shopping this year?

Source: Retail Economics consumer survey, September 2021. Sample size = 2,000

Source: Retail Economics consumer survey, September 2021. Sample size = 2,000